Bank of Canada Holds Rates Steady — What It Means If You’re Renewing Your Mortgage

Courtesy of the Globe & Mail, from the Bank of Canada

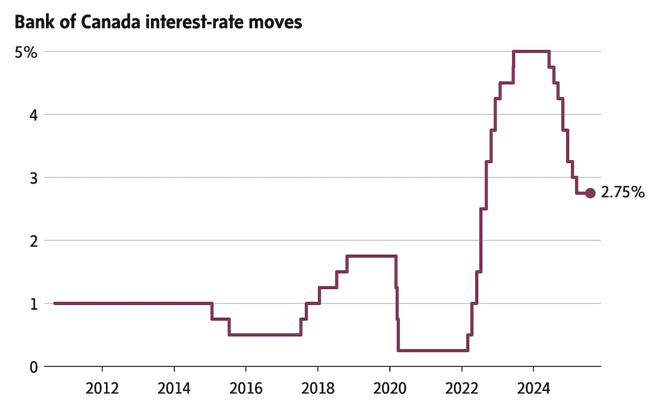

For the third time in a row, the Bank of Canada has chosen to hold its overnight lending rate steady — a decision that has real implications for Canadian homeowners, especially those facing mortgage renewals in 2024 and 2025.

If you were hoping for a rate cut this summer, you’re not alone — and unfortunately, you’re not getting one (yet).

Let’s break down what this means, where rates stand now, and why renewing homeowners still have more power than they think.

📉 No Rate Cut, No Relief (Yet)

The Bank’s latest announcement came as no surprise to economists, but it was still disappointing news for many homeowners.

Here’s the current landscape:

The BoC policy rate remains unchanged, despite high hopes for a cut

Five-year fixed mortgage rates remain in the 4.0–4.5% range

That’s still much higher than the sub-2% rates many Canadians locked in during 2020–2021

And the result? Households are feeling the squeeze — particularly those whose ultra-low pandemic rates are expiring. Renewals today often come with monthly payments hundreds or even thousands of dollars higher than what borrowers are used to.

💸 What About Mortgage Delinquencies?

Some of these payment shocks are starting to show up in the data — especially in Ontario and British Columbia, where home prices and mortgage amounts tend to be highest.

According to journalist Rachelle Younglai, we are seeing a rise in mortgage delinquency rates (people behind on their payments by 90+ days), but they are still coming up from historically low levels.

That means:

✅ It’s something to watch,

🚫 But it’s not a housing crisis — not yet.

Unless delinquencies become highly concentrated (like in one condo building or neighborhood), they’re unlikely to drive prices down in a meaningful way.

💼 The Unexpected Silver Lining: You Have Bargaining Power

Here’s the good news:

You might have more leverage at renewal than you realize.

Why? Because:

New mortgage rules make it easier than ever to switch lenders without jumping through requalification hoops.

Lenders are under pressure in this slower housing market — and they don’t want to lose your business.

This means you may be able to:

Shop around more freely for better rates

Negotiate discounts or flexible terms

Avoid paying the “lazy tax” of blindly renewing with your current lender

🧠 Bottom Line

✅ The Bank of Canada is playing it safe — holding rates while they wait for inflation to cool further.

✅ Homeowners renewing now face higher payments, but not without options.

✅ Switching lenders and negotiating can help ease the sting of a tough renewal.

👋 What I’m Seeing on the Ground

Here in Ontario, I’m helping clients every week who are renewing from 1.99% rates into 4.5% territory — and believe me, there is no one-size-fits-all solution.

Some are stretching amortizations to soften the blow.

Others are locking in short terms hoping for future cuts.

Some are refinancing to eliminate higher-interest debts in the process.

📞 If your mortgage is up for renewal in the next 6–12 months, don’t just wait and hope.

Let’s get proactive, weigh your options, and take advantage of every edge available to you.