Condo & Townhouse Maintenance Fees: Why They Matter More Than You Think

Image courtesy of MyChoice.ca

When touring condos or townhouses, buyers often focus on purchase price, location, and finishes—but maintenance fees can make or break your financial picture. These monthly payments cover shared building expenses, and understanding them is crucial for condo ownership. Here’s everything you need to know.

What Are Maintenance Fees?

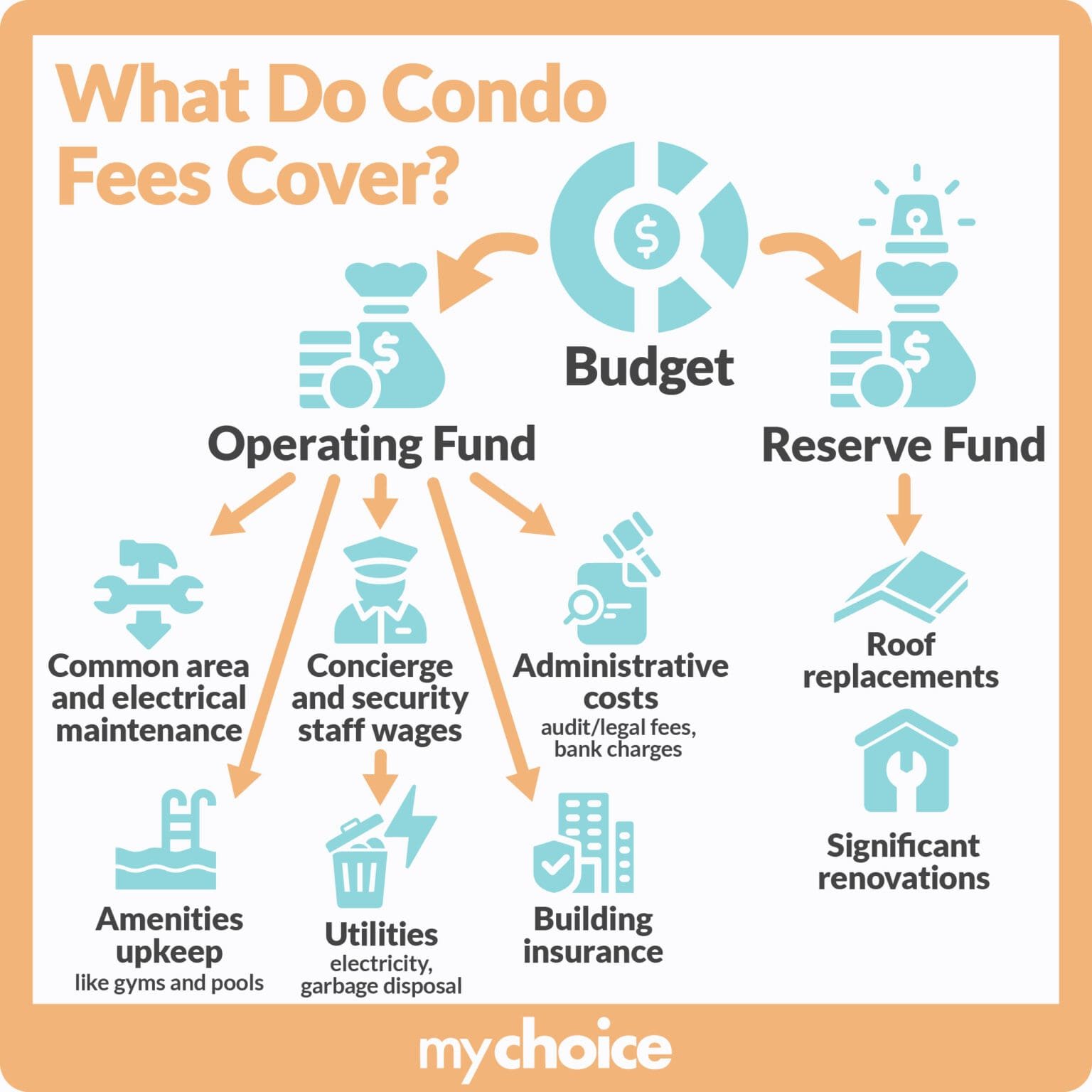

Maintenance fees pay for:

Building insurance (fire, liability, common areas)

Utilities (water, heat, sometimes hydro for common areas)

Reserve fund contributions (for future major repairs like roofs, elevators)

Common area maintenance (hallways, gym, pool, landscaping)

Management fees (professional property management)

Administrative costs (legal, accounting)

Average fees in Ontario (2026):

Low-rise condos/townhouses: $0.40–$0.70/sqft

High-rise condos: $0.70–$1.20/sqft

Example: 800sqft condo = $320–$960/month

Why People Hate Paying Fees (And Why They’re Essential)

The complaints I hear most:

“It’s like rent on top of my mortgage!”

“Why pay for amenities I never use?”

“Fees keep going up!”

The reality: Without fees, you’d pay these costs yourself—roof repairs ($50K+), insurance ($5K/year), snow removal ($2K/winter). Fees spread the risk and protect your investment.

Why fees matter:

Property value protection: Well-maintained buildings retain value better

Legal obligation: Condo corporations can lien your unit for unpaid fees

Future-proofing: Healthy reserve funds avoid special assessments

Who Oversees the Fees?

Condo Corporation Board (elected owners) sets the budget, but:

Professional property managers handle day-to-day operations

Annual audits ensure transparency

Owner meetings (AGM) approve budgets and major expenses

Reserve fund study (every 3 years) forecasts future costs

Red flags to watch:

Fees under $0.50/sqft (likely underfunded reserves)

Frequent special assessments

Board conflicts or poor communication

Example: Sarah’s $450 Monthly Fee Decision

Sarah found two identical 750sqft condos for $550K:

Condo A: $350/month fees (gym, pool, concierge)

Condo B: $520/month fees (same amenities + 20% higher reserve fund)

Condo A looked cheaper, but its status certificate showed underfunded reserves and a pending $15K/unit roof assessment. Condo B had healthy reserves and no immediate issues.

Sarah chose B. Two years later, Condo A owners faced $18K assessments while her fees rose only 3%.

How to Make the Most of Your Fees

Before buying:

Review status certificate (mandatory seller disclosure)

Check reserve fund health (aim for 70%+ funded)

Attend board meeting or talk to residents

Calculate total ownership cost (mortgage + fees + taxes)

After buying:

Get involved—run for the board or join committees

Use amenities—that’s what you’re paying for!

Vote smart at AGMs—challenge wasteful spending

Budget for 3-5% annual increases

Pro tip: Treat fees like strata insurance. You hope you never need it, but when the elevator breaks, you’re glad it’s covered.

Bottom Line

Maintenance fees aren’t “extra rent”—they’re investment protection. Shop for condos where fees reflect value, not avoidance. A $100/month fee difference today could save you $20K+ in future assessments.

Buying a condo or townhouse? I can help you decode status certificates, analyze fees, and find properties where your total ownership costs make sense. Contact Mr. Mortgage (Kechanth Kannan) today.

📸 Instagram: @_mrmortgage

Fees aren’t the enemy—poor condo governance is. Let’s find your perfect home, fees included.